SoFi, or Social Finance, was founded in 2011 by Mike Cagney, who has become the FinTech industry’s most prominent voice, a sort of radical sage of his own. He wields a master of science degree in management from the Stanford Graduate School of Business and was once senior vice president at Wells Fargo. He is also co-founder of a hedge fund, which makes him the kind of guy who should be a Wall Street darling, or at least an apologist for the system he is seeking to replace.

The times, they are a-changing.

So crooned last generation’s wisest sage, a reluctant messiah for a new world emerging from the not-yet-settled dust of a crumbling system based on values headed out of fashion. That system, however, was still being financed by the world’s banks. But if SoFi has anything to do with it, those banks will be supplanted by a new system of financing for the new set of values. The writing is on the wall, but the ink may yet be invisible.

Cagney hasn’t been shy about his criticisms of banks, saying they are nothing more than a utility. He delights in pointing out how millennials don’t trust them. And he’s on a mission to take advantage of that unfortunate state.

Putting the ‘Alternative’ in Alternative Lending

Last month, SoFi raised eyebrows with its purchase of Zenbanx, a mobile banking service that operates in the U.S. and Canada. Cagney said in a press release: “SoFi and Zenbanx share a vision that banking should and can be better, and have built products and services to do it. With Zenbanx joining SoFi, we’re moving one step closer to becoming the center of our members’ financial lives by adding SoFi deposit, money transfer, and credit card products to our offerings for members.” They’ve come a long way from offering student loan refinancing, their core startup product.

In fact, SoFi is the first company ever to offer refinancing for both federal and private student loans. They’re also the first online lender to offer mortgages, and the first company to offer mortgage pre-qualifications on mobile phones. If that’s not all, they were the first MPL to secure investment-grade ratings on senior notes from leading agencies. They’re also the first FinTech company to receive a AAA rating from a major rating agency, and, finally, they’re the first and only U.S.-based FinTech company to receive a $1 billion funding round.

That funding round was a Series E that ended in September 2015. Last month they announced a Series F raise of $500 million, bringing their total equity investment to $1.9 billion.

The first thing you see when you land on their website is a young man on a bicycle sporting a backpack and the words “Welcome to a new kind of finance company” sprawled across his torso. SoFi’s intention to become the financing alternative millennials crave and the financial services company their grandfathers never had may well be the reality the Bank of America fears. The home page of the website below the fold reads, “We’re all about helping you reach your next financial goal — great rates, zero fees, unprecedented service, and awesome member perks.”

Awesome is a subjective word, but it could be objectively true. One of those perks includes local dating events. It’s that kind of marketing and customer service that puts the “alternative” in alternative lending.

Why Student Loans Are So Important

College has always been an important part of the American cultural identity. Some of us would say it’s a part of the American dream. Young men and women went to college to begin their careers, to discover themselves, to find love and a life mate, and ultimately to learn life’s most important lessons. Previous generations thought it was so important that many young upstarts entered with a debt load in hopes that future earnings would offset the expense and create a better life for themselves and their children. Grants, loans, and a bevy of financial options were created by public and private entities for the sole purpose of helping young people achieve the dream. Somehow, it all went awry and today’s young people feel themselves strapped by student loan debt with no hope for paying it all off. What happened?

It’s hard to put a finger on it, but essentially, college tuition went up and the job market dried up. SoFi came along to help alleviate some of the stress of student loan debt and that’s made a big difference for many millennials.

“We invented student loan refinancing,” said Amanda Wood, SoFi’s director of business operations and strategy. “But we also want to help our members professionally and personally.” This help includes unemployment protection. “If you lose your job, we’ll help you find another one. It’s in our interest to do that, of course. We want to help our members get ahead in their lives.”

Unlike banks, which don’t seem to mind lending money but once they have your application and the amortization schedule in place, you’re left on your own.

SoFi has three student loan products: Refinancing, Parent loans, and Parent Plus refinancing. That final product allows individuals who took a Parent loan to refinance that loan later. In addition to student loans, SoFi has moved into unsecured personal lending where borrowers can consolidate credit card debt, finance a home improvement project or large purchase, pay for in vitro fertilization, or to make other purchases that can’t be done with a credit card. They also finance mortgages with as little as 10 percent down and no PMI.

One of SoFi’s more interesting products allows employers to help pay off a student’s loans, which is something SoFi itself does. The company contributes some of the funds to pay off student loans of its employees. But that money is taxed. SoFi wants to see it go tax-free.

“There is a bill in Congress right now to address that,” Wood said.

In fact, H.R. 795 will give employees a tax exemption for up to $5,250 per year to help them pay off student loan debt. Employers will also get a tax deduction for helping their employees pay off student loans. The bill was introduced by U.S. reps Rodney Davis (R-Ill.) and Scott Peters (D-Calif.).

In a press release announcing the bill early in March, Davis said, “Seven in ten college seniors last year graduated with student loan debt — which now represents the second highest form of consumer debt. This debt is a drag on our economy because it prevents many young adults from contributing to our economy. Many are putting off buying a house, purchasing a car, or saving for retirement.”

SoFi is one of several private companies supporting the bill. Other employers include Peanut Butter, GradFin, Gradifi, and Natixis Global Asset Management.

At a critical time in their lives when young adults are learning how to manage their finances, SoFi has made student loan refinancing a priority leading to other forms of financing that could keep millennials in SoFi’s customer pipeline their entire lives. Student loans could be seen as a gateway financial product.

What Lies Beyond Student Loans?

Lending products don’t end with students loans. That’s where they begin. While millennials tend to put off major purchases much later than previous generations, they aren’t completely ditching home and automobile purchases. That’s why SoFi has moved into mortgages and unsecured personal lending.

But that’s not all. They also offer term life insurance, and a wealth management product. They also plan to add checking accounts and credit cards, eventually, Wood said.

“We want to be the center of our members’ financial lives,” she said, “with products that are either better, or that members don’t have access to through banks.”

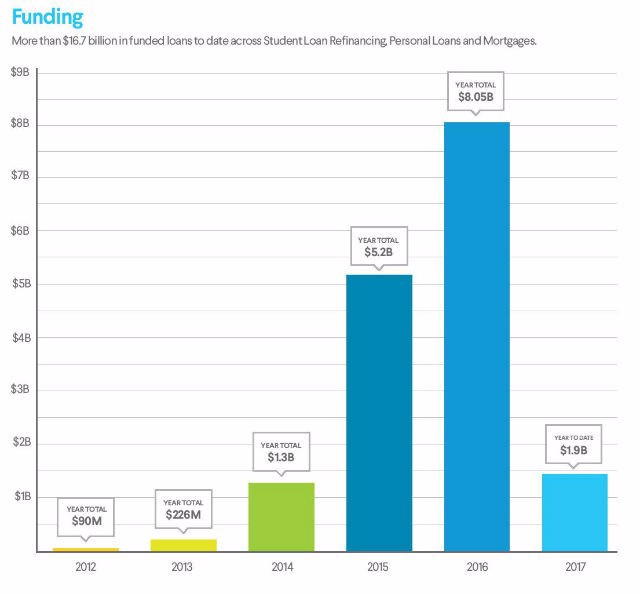

And they’re on a good run to make that happen. They’ve funded $16.7 billion in loans to more than 250,000 members boasting a savings of more than $1.45 billion for their borrowers. The average time it takes to close a SoFi mortgage is 40 days. Members can get pre-approved and pre-qualified in minutes by applying online. Wood said members like the speed and transparency offered by SoFi products.

“We want to be a household name,” she said, “so that people come to us for everything they need. We want to be the center of their lives — for careers, for their personal lives, for networking, everything.”

And they’re succeeding on that point, too. Their NPS score is a record high 90. They’ve helped almost 300 members secure new jobs through the SoFi Career Strategy Team. They’ve helped more than 65 entrepreneurs receive 6-month loan deferrals. And there are more than 650 companies that offer SoFi as a benefit to employees. They’ve come a long way since offering student loan refis at Stanford and other elite schools.

“There is a perception that we’re only interested in pursuing top income earners for our customer base,” Wood said, “but we don’t want to lend to borrowers who can’t repay us. We’re not exclusive, we just look at people a different way.”

Instead of assessing risk by measuring debt-to-income ratio like most lenders, SoFi looks at cash flow and a history of financial responsibility. And that sets them apart from banks, by a long shot.

The Ingredients of SoFi Culture

These aren’t the only things that make SoFi different than traditional banks. In many ways, they’re also different than most online lenders. It could be why they’re leading the pack.

One important way is how they advertise their products. Direct mail has become an industry norm. Lending Club and Prosper do it. So does SoFi. But not all online lenders can afford to run a Super Bowl ad, which generally costs millions. This year, SoFi aired a Super Bowl commercial during the game’s historic overtime period. The move put them among the ranks of the world’s biggest brands including McDonald’s, Budweiser, Pepsi, Kia, Skittles, Google, Audi, Febreze, and TurboTax, just to name a few.

“It was a lucky gamble on our part,” Wood said. “We decided, since we had an option to run it in overtime, to throw something together at the last minute.”

It was more than a gamble. The Super Bowl was a historic event, the first time it has ever gone into overtime and Fox executives decided to make a deal for advertisers willing to sponsor the event during those few minutes of game time. SoFi was one of four advertisers that took the deal.

“It was very expensive, but it did cost less than other Super Bowl advertising,” Wood said.

The ad consisted of user-generated content, videos and pictures sent from SoFi members. This excited the entire SoFi team even though it was a lot of hard work in a short period of time to piece together the video.

“The reception of our members was very positive,” Wood said. “They were surprised to see their pictures during the game.”

Most advertisers would have used paid actors. But Wood said SoFi was pleased with the response the ad generated and the extra exposure to potential new members.

While the Super Bowl ad was expensive, Wood said SoFi does advertise on television quite a bit, usually during March Madness.

“We try to figure out where our type of customer will be watching,” she said. “We run a lot of SoFi mortgage ads on home improvement shows. We run the student loan refinance ads during college and other sporting events. It’s just one part of our larger marketing strategy.”

SoFi’s growth can be seen in more than just its financial data. It can also be seen in the number of employees it has, almost 900 today. Most of those are in the San Francisco office. Then there are a couple of hundred at an office in Salt Lake City, Utah. Other offices are located in New York City; Reston, Virginia; Healdsburg, California; Helena, Montana, and The Woodlands, Texas.

There’s more than enough evidence to show that SoFi is a different kind of finance company. Their customers value speed and transparency, and that’s what the company offers.

“We’re in a better position to do it than traditional financial institutions,” Wood said. “We do everything online so there’s no need to have a physical branch for anything.”

Someday, all banks may be branchless. Then we can say SoFi was a true pioneer.