The purpose of this analysis is to execute an objective and quantitative evaluation of the Ethereum network. Why? Ethereum’s token ETH price has been in a spectacular free fall for the past few months. From a high of over $1400 in January 2018 to the May push to almost $800, ETH has now reached lows around $240. This surprising price movement made me want to reconsider my thoughts on Ethereum again from scratch and without emotions.

In addition groups are targeting the Ethereum network with a negative campaign using the same strategy they used against IOTA in the past as you can read here. Therefore I would like to make my own opinion.

Background

I would like to present my background so that you understand my point of view:

- Have been in the currencies business for 10+ years.

- Established a business around market making, high-frequency trading, brokerage tech in currencies with 5 offices around the world and trading $100bil per month.

- Built Luna Cap Ventures: making venture debt loans to early-stage companies.

- Created companies from scratch multiple companies in fintech, craft breweries, augmented reality, etc.

- I am an engineer and scientist by background (a diploma from MIT among others). My bio is below if you would like to learn more.

Also as a disclaimer: I believe in the opportunity offered by the Ethereum network. I participated in a few ICOs. Some of them are the PIX token which I run ( www.pixtoken.co) , First Blood (1ST token), Air Fox (AIR token), etc. However, I try to re-evaluate the pros and cons of projects I am involved with regularly. That is to make sure my decisions are logical and objective.

Evaluation

THE “PROs”

· Team:

Every company in my eyes is first measured through its team. Ethereum’s team is the key to its success. Led by founder and inventor- Vitalik Buterin, the community, has talented members in Vlad Zamfir, Joseph Lubin and others. Even more important is that the team is focused on building Ethereum as compared to just cashing in the chips.

The team has time and again delivered on its promises and has solved tricky issues successfully; DAO hack and DoS attacks being case-in-point. Its foundation and Devcon events are again initiatives which set the team apart.

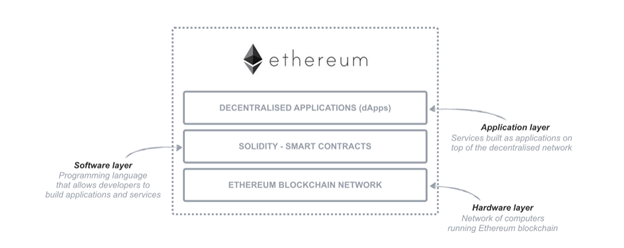

· Leverages blockchain:

Ethereum cannot operate without a blockchain infrastructure. Therefore, it is the perfect example of a project leveraging the advantages of the blockchain. Blockchain also gives Ethereum an edge that no other centralized company has.

· Functionality:

ERC 20 has become the de facto standard for fundraising in the ICO world. According to a list updated in November 2017, eidoo.io has issued a list of almost 500 tokens built on the Ethereum network. ERC-20 tokens have raised an estimated $5.5 billion in 2017 and 6.5 billion in q1 2018. This is unmatched across the crypto universe. Cryptokitties’ success shows that Ethereum is not restricted as just a medium of exchange but has myriad applications in the field of gaming, ID verification, escrow management, and prediction markets.

ERC-721, the other promising standard for non-fungible tokens, will probably bring to the Ethereum network the tokenization of items for games and other similar collectibles.

Furthermore the tokenization of securities, which I expect will be the next big wave of token creation, is likely to happen on the Ethereum network as well.

· Colossal community:

Andrew Keys, co-founder of Consensys Capital believes that Ethereum has 30 times more developer than the next blockchain community. Another analysis estimates 250,000 Ethereum developers in the crypto ecosystem. Moreover, we all know the size of the developer community is a crucial indicator of which network will win out in the long run.

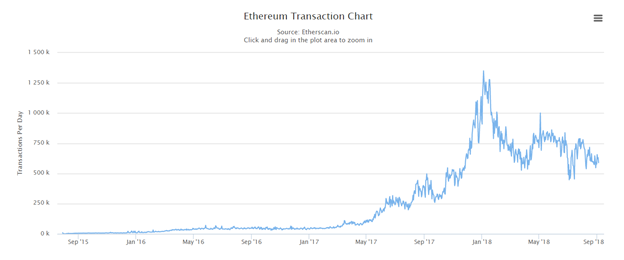

· Per day traffic:

Ethereum has recorded 620,267 in transactions on September 2, 2018. As compared to bitcoin transactions which only managed to reach 187,001 transactions on the same date. This shows that the blockchain community is more actively using the Ethereum platform.

· Consensys:

Ethereum’s founder Joseph Lubin launched Consensys in 2015 to develop software and applications on top of the Ethereum network. It has had a synergistic relationship with ethereum. It has grown as the go-to ethereum developer and simultaneously has helped ethereum have a core developer base from early on touting its benefits. Consensys now boasts an almost 1,000 person team based out of Brooklyn. No other smart contract network has such a successful community or consulting arm aligned with making it successful.

· Demonstrated security:

The Ethereum platform has had its share of security scares, but the network has been able to grow despite these setbacks. And even though bugs have been found in its smart contracts, they have not led to any significant issues. Many newer networks, especially more centralized ones, continue to have security issues or are not security proven.

· Clear regulatory views:

The SEC determined in June 2018 that Ethereum is not a security; this is considered as a landmark announcement for the entire crypto industry. This ensures that the platform does not come under the ambit of the regulatory framework as required in case of securities. This also clears any regulatory or legal overhang over the cryptocurrency.

· Geographically diverse:

Ethereum is a genuinely global cryptocurrency with no centralization / over-concentration of users. This ensures that no single regulatory decision can have a major impact on the currency as compared to certain tokens which are only popular in their home countries.

· True Decentralization:

Ethereum outnumbers other cryptocurrencies like Bitcoin and Ripple in regards to the number of nodes around the globe. Ethereum has a total of 15,791 nodes whereas Bitcoin has 9,678 nodes and Ripple has only 809 nodes. The higher number of Ethereum nodes represents true decentralization.

· Proven reliability:

One of Ethereum’s unique selling proposition is that it has very little downtime. Therefore, making it ideal for building mission-critical Dapps. Since it works on thousands of nodes and is decentralized, the last downtime was major congestion at the height of the cryptokitties craze in December 2017.

· Vested interest from famous Venture Capitalists:

Marquee VC funds and angels have backed up the Ethereum network directly or indirectly by investing in projects and companies that rely or are built on top of ETH. For instance, CryptoKitties, the ethereum based virtual game has fetched funding amounting to $12 million. Investors included big names like Andreessen Horowitz and Union Square Ventures (top 2 venture capital firms), Naval Ravikant (the founder of AngelList), Fred Ehrsam (former co-founder of Coinbase) etc. The funding attracted by ERC20 tokens has already been discussed in detail above.

· Future roadmap:

Ethereum has a well defined roadmap for the future. Ethereum continues to keep in equilibrium the 3 principal trade-offs of decentralization, scalability and security. The developer community is able to make changes to the road map in a productive way like in the reduction of ETH awarded per mined block in August 2018. Clear milestones with useful features are being worked upon with new release called Constantinople expected by the end of October 2018.

Vitalik, in an interview reiterated his commitment to scale the ethereum network and is confident that with second layer solutions like Plasma and Sharding, Ethereum will be able to process over 1 million transactions per second.

THE “CONs”

As with any organization there are a certain number of CONs.

· Sluggish transaction speed:

Ethereum’s proof-of-work mechanism for validating transactions has made the network slower and open to congestion. Certainly, the team is famous for taking a stand on security, stability, and cost. The DAO hack and the eventual fork is a testimony to their principles. This means that development has been slow and it has lagged in rolling out updates to the network. However, this slow development is justified by not compromising on the tradeoff of speed, decentralization and security.

· First-mover disadvantage:

Ethereum has earned the first-mover disadvantage. It is now the legacy network which is the standard bearer. So all new startups are learning from the incumbent and are nimble enough to ensure faster development and execution. This can be an unknown threat in the long run. Also good-follower companies can learn from Ethereum’s mistakes and possibly build better networks.

· Market Hoaxes:

Cryptocurrencies are super-volatile. Market rumours affect them profoundly. A recent hoax about the death of Vitalik led to a $4 billion selloff. This raises the question that is Ethereum too dependent on its mercurial founder?

· PoS update:

Its pivot to Proof of Stake has been pending for some time now. Subsequently, this has led to questions if the team will be able to meet the timelines. But the upcoming Constantinople Hard Fork is considered to be the final step before shifting to PoS.

Pros-Cons conclusion

While the pros, in my eyes, outnumber and outweigh the cons it is important to keep an eye on the cons. However, I believe that traction through usages, community size, number of transfers, etc. outweigh all the cons or claims of other networks that claim to be able to do better. It is easy to make a claim that one can do better, but until it is working in production I will always be skeptical. In addition, the Ethereum network is able to change and adapt as Vitalik has demonstrated regularly. Therefore I believe that if another network finds a better technical solution to a problem, nothing prevent Ethereum from learning from that experience and adapting.

Ethereum has the user base and the community size, and those form a moat that is extremely hard to compete with.

VALUATION OF THE NETWORK

The cryptocurrency market has always been susceptible to volatility. Market gyrations aside, we need to consider on how to value the underlying network. Therefore, there have been multiple attempts at creating a framework for the same:

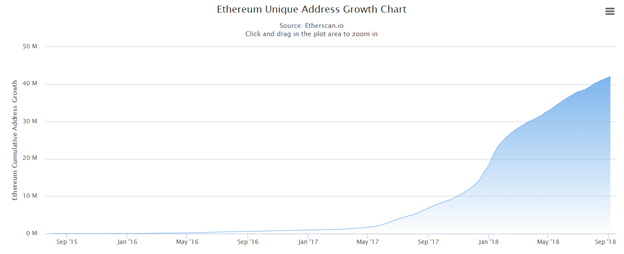

The basic valuation of the network is the Metcalfe value. In short, the value of the network is proportional to the square of the number of participants. As you can see on Etherscan the number of addresses in the network and the number of transactions continue to value the ETH network as an increase in value and not a decrease in value.

However some people believe that using the Metcalf law is not optimal. Here are other methods that are specifically designed for blockchain networks:

NVT (Network Value to Transactions) ratio

Also known as the crypto PE ratio, it is defined as:

NVT = Network Value/Daily Transaction Value.

Multiple researchers have come out with slightly modified versions of the formula. It is currently considered as an important benchmark for identifying pricing bubbles.

Using this method once again the value of the network should be above the present price by a lot. If we also take into account the Ethereum network potential the present price is once again illogical.

NVM (Network Value to Metcalfe) ratio

In this method, we calculate the upper and lower bounds of the Network Value using distinct versions of the Metcalfe Law. These are based on the DAA (Daily active Addresses). With the help of these bounds, a bottom-up valuation of the network as a function of DAA is established.

Network valuation conclusion

To conclude on the network value metric: using any possible rational metric, I believe that the Ethereum network and the ETH token are increasing in value. The trend is clear and while there will be variations in price the overall trend is one way.

CONCLUSION

I have been assessing the Ethereum network and its strengths since October 2015. To sum up, today’s analysis of the Ethereum network continues to make me very comfortable. The network’s developer community, the team strengths and the support from famous Venture Capitalists along with an overall ecosystem size and health are extremely strong. Medium and long-term I am comfortable and very positive about the network. I am a net buyer of ETH in the present market conditions. My strategy is to buy small amounts at regular intervals, as it is impossible to predict a permanent low for the currency.