Today, in the US, crypto coins are seen as property by the IRS. Therefore, according to policy, if you want today to pay for your coffee with 0.00075 Bitcoins worth about $5 dollars, you also must pay tax on these 0.00075 Bitcoin you just spent.

Tax details

What tax? Here is a rough way on what this tax is. You have to calculate at what USD/BTC price you purchased these 0.00075 Bitcoins, lets say $250 per Bitcoin. You have to look at what USD price you sold these bitcoins, lets say today at $6600. Then you have to look up your tax rate, lets say 30%. Therefore in addition of paying for your coffee with 0.000075 BTC you also have to write a check to the IRS for 0.00075*(6600–250)*0.30=$1.42

Now imagine you make multiple BTC purchases per day. Imagine you purchased BTC about once a month in the last few years. And imagine you also exchanged BTC for ETH and other crypto currencies.

Oh, and how will you find the $1.42 to pay to the IRS? You will probably have to sell more Bitcoins to get these $1.42. And each time you sell Bitcoins for anything, being USD or another crypto currency or you use them to make a payment for some goods or services, it is a taxable event of course.

Therefore, as a lawful American, compare doing business in US Dollars vs making payments in crypto currency.

One can easily see that the tax processing burden for each transaction is so onerous that it is unlikely that crypto currencies will ever be used in the US for every day purchases lawfully.

US vs China

In technology and finance the world often looks at the US for innovation. Credit Cards were a US invention. The US plays a key role in the SWIFT payments system. The US Dollar, because oil has been priced in US dollars since the 1970s, is the de facto reserve currency of the world.

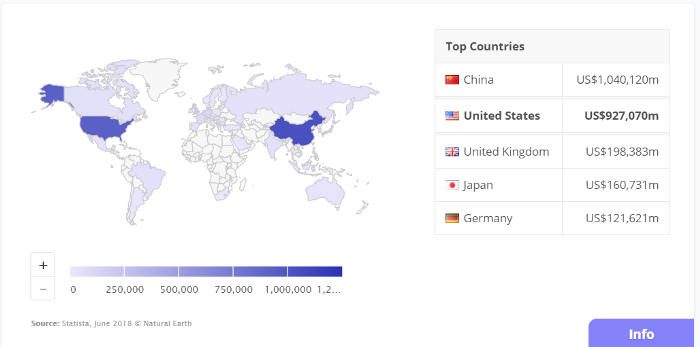

However, in digital payments China has now taken the lead. China is already the leader in Digital Payments ahead of the United States.

Figure 1 — Transaction value in million US$ in digital payments. China reaches the highest value worldwide, with a total transaction value of US$1,040,120m in 2018.

Tax policy is the main lever, that government uses, to encourage and discourage economic activity, that is in the interest of a country.

In Germany when one purchases goods or services with crypto one has to pay VAT tax which is similar to sales tax in the US.

If the United States wants to remain competitive and continue playing the international role it has played since the World War 1 in finance and technology it must stay at least in line with its peers in tax policy.

I strongly believe that a simpler tax policy that will allow consumers and businesses to explore using crypto currencies as a payment method is needed.

Advantages of using crypto for payments

Why would the US care in particular about crypto payments?

I strongly believe that crypto payments are particularly adapted for digital payments for many reasons:

- Crypto payments costs in the 0–1% range vs 2–5% for credit cards

- The payment with many crypto currencies is practically instantaneous world wide

- It allows for cross border payments cheap, fast and reliably

- There are no charge backs — merchants have the cash right away

- It allows for payments between parties who don’t trust each other

- The entire payments ledger is public and can be used for credit decisions, reports, by tax authorities, etc.

I believe it is just a matter of time before the US tax policy on crypto assets will be reviewed. I look forward to being able to pay for my coffee with a crypto currency in New York.