Nigel Morris is a co-founder of Capital One and has led it to emerge as a multi-billion dollar behemoth. During his time at Capital One, he noticed there is a gap between banks and the fintech industry. To bridge this void, his team rolled out QED Investors in 2007 and was able to bring on board some ex-colleagues from Capital One to build QED; this helped him to ensure the team hit the ground running. QED has invested in multiple startups that have not only become unicorns, but have changed the entire landscape of the financial ecosystem in which they operate. Most notable are Credit Karma, SoFi, Prosper, GreenSky, BrainTree, and ApplePie.

Fintech Opportunities and Hindrances

Morris has seen the best and worst of big banking and fintech startups. He has seen that banks have some really important assets that fintech companies lack: low-cost deposits, regulatory access, top-notch compliance, huge customer base, and high profitability. But they are trying to be everything to everyone and this is where fintech companies are gaining ground. Fintech companies, rather than offering everything, offer a specific product or service that banks haven’t developed or cannot develop because that is just not part of their DNA.

Fintechs

On the other hand, Fintechs have been extremely nimble. They evolved into dominating spaces that have been vacated or neglected by banks, online consumer lending and small business lending being prime examples. However, banks have accepted the hard truth and have started striking partnerships with fintech lenders.

On the other hand, Fintechs have been extremely nimble. They evolved into dominating spaces that have been vacated or neglected by banks, online consumer lending and small business lending being prime examples. However, banks have accepted the hard truth and have started striking partnerships with fintech lenders.

Morris is of the opinion that both sectors had been operating in silos. Though both have “complementary sets of skills,” they have only now really started communicating and exploring opportunities together. This lack of being able to meet on common ground was more of a cultural issue than anything. Startups do not understand or appreciate the hierarchy and sometimes bureaucratic structural setup of banks, and banks obviously are extremely wary of aligning themselves with unwieldy trigger-happy startups that can land them in a regulatory mess. So this communication gap is the biggest hindrance that both sides need to overcome to make this partnership work.

Bridging the Bank-Fintech Gap

In their endeavor to bridge the gap, QED has taken massive strides in the last six months by striking groundbreaking partnerships–one with Fifth Third in Cincinnati and another with Scotia Bank in Toronto. This partnership is beneficial for all three parties involved: Banks, Fintech companies, and QED.

Fifth Third has invested heavily in QED portfolio companies like GreenSky, ApplePie Capital, and AvidXchange. The focus of the Scotia relationship is in Latin America as they have a tremendous presence in LatAm and Central American countries outside of Brazil. They are exploring multiple opportunities together in those markets and should be able to announce a groundbreaking deal soon.

The QED Matrix

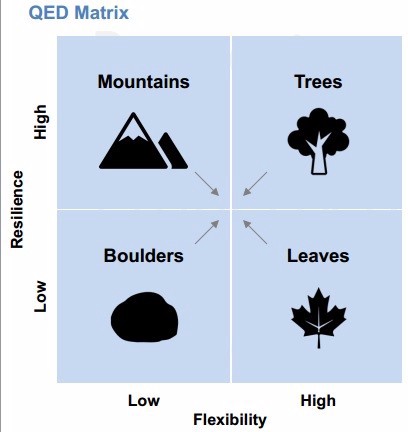

Nigel Morris believes that differentiating between fintechs and banks on a single perimeter is not feasible or sufficient. That’s why he came up with the QED Matrix.

The matrix has been developed on the lines of the BCG matrix (which is used for analyzing business units). The QED Matrix shows the trade-offs in the business model structure of the financial service institutions. The gist of is that each quadrant has its strengths and weaknesses, so entities moving towards the center are in the best shape.

The Matrix is based on two spectrums:

- Resilience is a function of factors like brand capitalization and product suite diversification;

- Flexibility concerns both infrastructure and decision making, and also includes organizational design, technology, culture, talent, and much more.

Classifications of each quadrant

- Mountains — Firms listed as mountains are high in resilience and low in flexibility. They have resilience because businesses have product diversity, brand, capital reserves, distribution networks, and low cost of capital. But low in flexibility due to institutional inertia, low growth, technical debt, and focus on regulation and cost reduction.

Examples: Citibank, Fifth Third Bank, Suntrust etc.

- Boulders — Firms under this quadrant represents low resilience and low flexibility. Low resilience due to lack of capital reserves or product diversification of larger banks. They also lack in flexibility due to legacy infrastructure, weak talent pipeline etc.

Examples: Regional banks, Credit unions, Community banks.

- Trees — Trees represent high resilience and high flexibility. High resilience due to factors like product diversification and loyal customer base and high flexibility due to clutter-free organizational structure, less technical debt, and open access to talent.

Examples: SoFi

- Leaves — Firms under this quadrant represents low resilience and high flexibility. Low resilience due to product concentration and lack of stable low-cost capital. High in flexibility due to simple organizational structure, technology infrastructure, etc.

Examples: GreenSky, Avant

Analysis

Obviously, Trees represent the best of both worlds. But the thought process behind the QED Matrix is for banks and fintechs to realize, firstly, where they are in the matrix. Secondly, what type of partnerships should they pursue to ensure they remain relevant in the twenty-first century. So a boulder should look to partner with leaves so that its customer base can be monetized properly. Leaves should look to partner with mountains. So that they have access to cheaper capital and a diversified offering and customer base. Whatever the situation, QED is sitting in the middle of the matrix. It is not only a capital provider to fintechs, but also the creator of a platform for dialogue with banks; this should help it become the first choice for entrepreneurs looking to build a sustainable fintech business.

Read about Nigel Morris’s LendIt USA 2017 keynote titled “If I Were to Start a Bank Today, This is What It Would Look Like.”