It is just the beginning of the coin offering market. In this article we, Block X Bank, an investment bank focused on blockchain, will be exploring using the best data available the past, present and future of the Initial Coin Offering (ICO) market.

Total potential market size

Private Equity Assets under management are valued in total to about $2.5 trillion USD. A Private Equity investor is typically locked in for 7 to 10 years. In general, the investment is difficult to value during that time. And the investor receives back their payment at the time that is solely at the discretion of the fund manager.

Imagine a world where most crypto-coins are regulated securities trading on regulated securities exchanges. And shares in companies, cash flows, dividends, interests, notes, and other existing proven financial products back these coins.

Crypto-coins and initial coin offerings have in fact even more advantages. Initial coin offerings enable companies to not only raise money. It also allows to get a set of initial customers and to build a community. This community will then also act as marketing agents and soft influencers. Consequently, they will help to promote the company and product as they have a vested interest in them being successful.

Market state

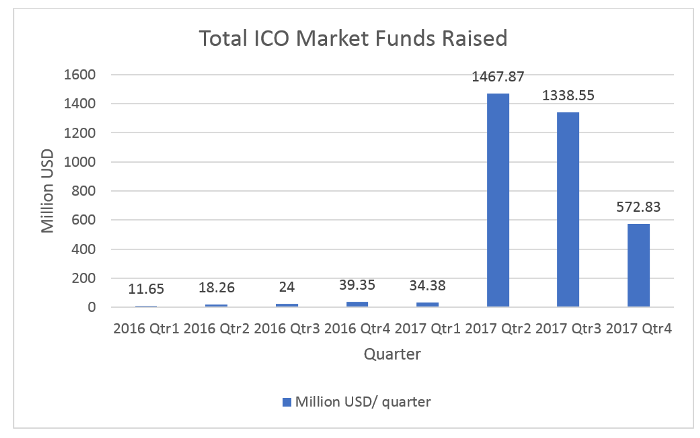

Per data from ICO Raises ICOs have raised approximatively about $3.494 billion until Dec 15 2017.

The general rule of thumb is that the average crypto holder will likely diversify into riskier and potentially higher return tokens about 5% to 10% of their portfolio.

As of December 19th 2017 according to Coinmarketcap crypto market participants held the total value of roughly $600 billion USD of tokens (in other words, the market cap).

Therefore, we expect that about $30bil to $60bil in value is available for Initial Coin Offerings and other high-risk high-reward investments in the crypto space.

Some of these $30bil will probably be used for day trading and highly speculative pump-and-dumps or similar “business ventures”. We assume that a significant percentage , perhaps 20% of it at least, will still be used for Initial Coin Offerings.

Therefore, Block X Bank estimates that about there is additional demand for $3 to $5bil in ICOs as of December 2017.

From business-plans only to revenue-generating companies

The Initial Coin Offering market started with funding very early stage companies who only have a business plan. We have already noted that in the second half of 2017 the ICO market is now trending more towards companies with existing revenue, customers and working products. Early stage companies are still successful but only if they have a famous investor. Because, the investor puts their seal of approval by investing in the project first.

Basic economic cycle of ICO market

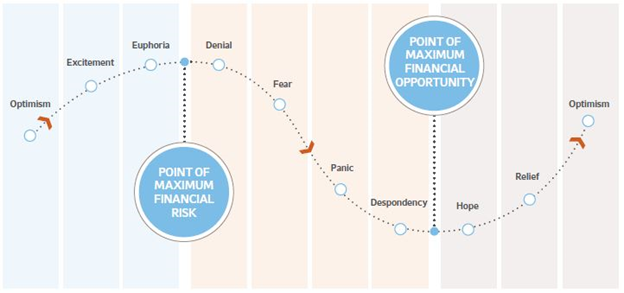

Despite this move towards more established companies the Initial Coin Offering market also goes through the standard economic cycles.

The well know cycle of human emotions as applied to market cycles:

ICO Market timing

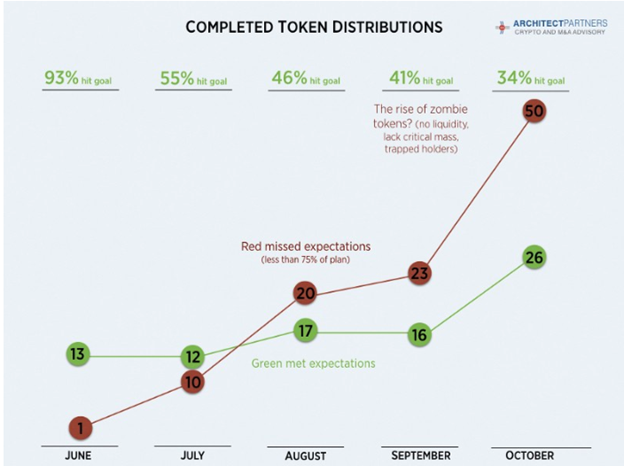

Using data from Icoraises we have plotted the following ICO market raise chart:

As you can see the amount of money raised in ICOs is following roughly the theoretical cycle mentioned above.

Here is more data to confirm the chart above:

Timing

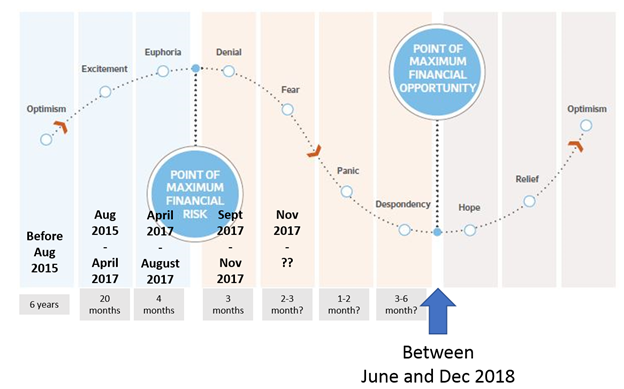

I believe the initial coin offerings market cycle timings were as follows. Here is a chart showing in our opinion the timings of these different cycles:

Conclusion

Us exploring ICO market led us to conclusion that the coin offering market is expected to be of maximum opportunity between June 2018 and December 2018.

We believe that both companies and investors moving forward will seek to work only with ICOs represented by credible investment banks with a proven track record. Who are themselves investing their own funds in the companies they take to ICO.

In full disclosure, I am the founder and Managing Partner of Block X Bank which is such an organization.

We believe that crypto-coin offerings will become a major financial product and we are just at the beginning of this path.