In my eyes volatility is what is preventing crypto currencies from being more used for payments in online commerce.

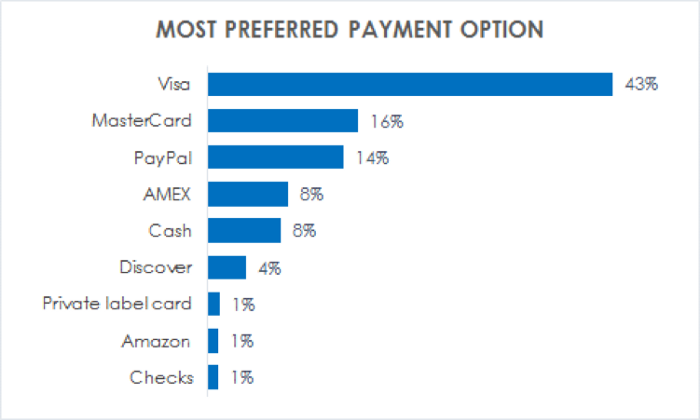

I believe that crypto currencies are much better adapted than credit cards for online payments (faster, cheaper, non-reversible, simpler, etc). And yet crypto currencies are hardly used at all:

BTC is 300x more volatile than EUR

I strongly believe that lack of adoption is due to the crypto’s volatility. Merchants have costs in fiat currency (USD for example). Having a BTC price for their product that changes by 30% a week is not manageable and provides poor customer experience. Imagine if you wanted to buy a car and the price was today 10 BTC and tomorrow 13 BTC and day after 7 BTC while the normal consumers haggles over $200 for the price of the a $40,000 car and needs hours/days to make the payment. This is not manageable.

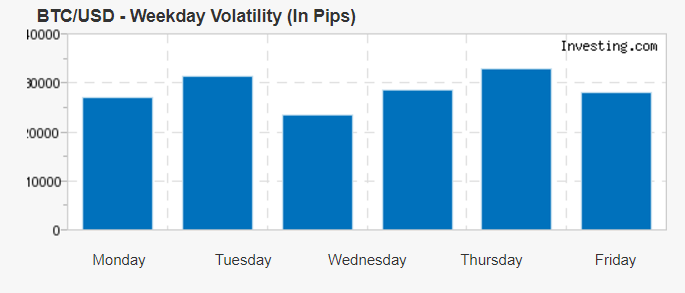

The volatility of BTC/USD (one of the least volatile crypto currencies lately) :

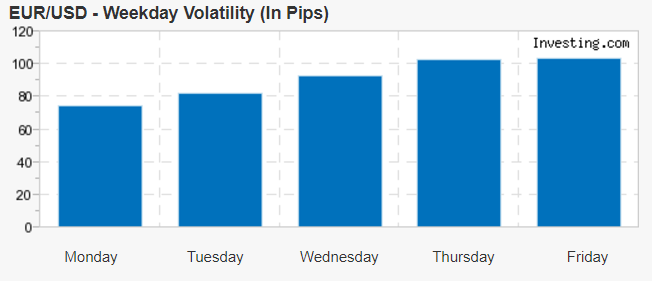

Compare to the volatility of EUR/USD:

In other words BTC is 300x more volatile than EUR compared to the USD currency.

Cap the volatility but don’t choke it

The solution is to create a crypto currency who’s volatility is capped but which is allowed to vary.

Tether (USDT) is a crypto currency who’s volatility is “controlled”. But it is too “controlled” as 1 USDT is meant to be worth as close as possible to 1 USD. However, that is not the answer neither.

A currency is meant to appreciate and depreciate to follow the economic cycle as well as offer and demand for the currency. It is meant to have inflation to encourage spending. Inflation is an indicator of the economic health.

I believe that inflation and currency appreciation are key mechanisms to encourage currency spending, investment, credit, savings, etc. These mechanisms have been tested for hundreds of years in modern economies and seems to be the best standard to date.

The plan: how to create such a crypto currency?

In the fiat world central banks print and withdraw fiat money to control inflation and currency supply. In addition they control the central bank interest rate at which banks can borrow the currency. This central rate also has a large impact on inflation and many other economic aspects.

I propose the following for the Central Bank of Crypto (CBC) and it’s Crypto Dollar (CUSD):

- CBC should be a smart contract.

- CBC should have the capacity to print CUSD or destroy CUSD

- CBC should connect via API to the top 10 Crypto exchanges where CUSD is listed

- CBC’s smart contract should (if needed) print and sell into the markets or buy CUSD into the markets to make sure CUSD exchange rate to USD doesn’t change by more than X% (see below) per week.

- The X% max vol rate should be changeable over time. The mechanism through which it changes should be through a vote.

- And the CBC should be launched with a minimum inventory of ETH to enable it to buy CUSD if it’s value goes down at first. An ICO will be needed for this purpose.

A few comments

- I believe the main risk here is running out of ETH to help support CUSD if the price drops too fast/much. Perhaps a solution would be for the contract to borrow ETH from volunteers who can submit their ETH in a dutch action with reverse interest rates auction?

- The whole idea is for the Central Bank of Crypto to be fully directed by a smart contract. It shouldn’t rely on any particular human or human group. It should be decentralized. That is in my eyes the key for this system to function properly. And decentralization is the key in the crypto space.

Please help us with comments to this idea.

—

Thank you! I would like to thank Marijana G for pointing out clearly the problem and for the ongoing crypto discussions on all themes.

About the author

George is the Managing Partner of Block X Bank, Co-founder and CEO of Lampix, and the Founder and Editor-in-Chief of Lending Times.

George has obtained 3 Master’s Degrees: a Master’s of Science from MIT working on 3D printing, a Master’s in Electrical Engineering and Computer Science from Supelec, France and a Master’s in Nanosciences from Paris XI University. His scientific career led to 10 publications and patents.

George is an advisor for FirstBlood, an eSports gaming platform, and Chairman of the Board of Advisors for Gatecoin, a bitcoin and ethereum token exchange based in Hong Kong. Previously George was a partner at LunaCap Ventures, a hybrid early stage growth capital fund. George also advises over a dozen companies in finance.

George had a successful exit from Boston Technologies (BT) in 2014. BT was a technology, market maker, high-frequency trading and inter-broker broker-dealer in the foreign exchange spot, precious metals and CFDs space company. Boston Business Journal listed BT in the Fastest-Growing Private Companies in Massachusetts by tin 2011. BT has been on the Inc. 500/5000 list of fastest growing companies in the US for 4 years in a row ( #143, #373, #897 and #1270), and Boston Business Journal included George in the top 40 under 40 in 2012 in recognition of his business achievements.

Over the last 10 years, George founded multiple companies in online lending, craft beer brewery, exotic sports car rental space, hedge funds, peer-reviewed scientific journal, etc. George advised 30+ early stage start-ups and served as a mentor for MIT’s Venture Mentoring Services and Techstars Fintech in New York.

George is originally from Romania and grew up in Paris, France. He currently lives in New York City.