Initial Coin Offering (ICO) is the next big thing in the world of fundraising. It combines the features of an IPO and crowdfunding allowing backers to support a startup via donations while generating massive returns on their investment. ICO is basically crowdfunding of a new cryptocurrency venture where a percentage of the cryptocurrency (and not the venture itself) is sold. This new cryptocurrency is usually sold for a fiat currency or other mainstream cryptocurrency like bitcoin.

For many decades, any startup looking for funding would have to go to a VC firm, the self-appointed gatekeepers to capital. Crowdfunding in general, and sites like Kickstarter in particular, democratized the funding process. It allowed young companies to get themselves directly in front of prospective consumers and raise funds from backers.

ICO Roots

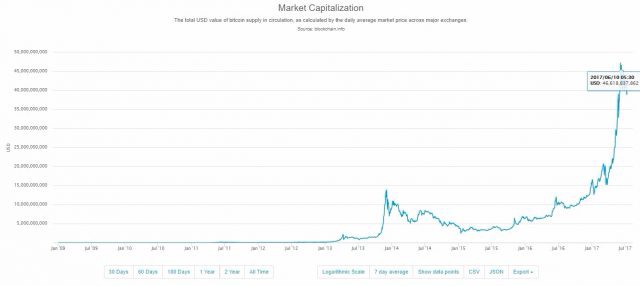

ICO, also known as crowd sale or token sale, emerged in 2013 as a fundraising option. Bitcoin, born in 2009, started gaining traction in 2013 and inspired to the birth of Ethereum and Ripple amongst the first ICOs. Below is a chart depicting the market capitalization (more than $45 billion) of Bitcoin. Ethereum had reached a market map of over $30 billion in June 2017.

One of the first cryptocurrency ICOs was by Ripple in 2013. Ripple Lab developed an innovative payment system called Ripple and produced 100 billion XRP tokens, then sold those coins to fund the platform. Ethereum sold its ETH for 0.0005 Bitcoin and received nearly $20 million on the ICO.

Comparison with IPO

One needs to granularly bifurcate the intricacies of both fundraising techniques to draw parallels between the two. The one major underlying difference is ownership stake. Under an IPO, shares released always denote ownership in the respective company, whereas ICO does not represent a stake in the company by design. With an ICO, more coins mean more voting power but, generally, tokens are used in exchange for other currencies.

Another difference is regulation. In most countries, IPOs are heavily regulated, and non-compliance can lead to dire consequences whereas ICOs are still in the regulation’s so-called “gray” area. Therefore, any project can be launched, and anyone from around the world can invest in the project. This relaxed environment no doubt presents a window of opportunity, but it also becomes riskier as compared to regulated financial instruments.

Bad Apples

As with any new phenomenon, there are bound to be some bad apples. ICOs are no exception. The ICO boom has really picked up in the last year or so. Fly-by-night operators looking to scam the general public have also entered the market. Matchpool, Bitbay and many others, have been embroiled. As the platform has matured, investors are becoming more discerning and the initial gold rush should subside into something more sustainable.

Legality

In actual terms, ICO legally is still undefined. Reason being, tokens, or coins, are sold in the form of digital goods and not as financial assets. That is why it is called a “crowd sale.” This has simplified the process of raising funds, but the unprecedented success of ICOs like DAO, a stateless investment fund, has caught the eye of regulators, and it will not be long before regulations kick in. The SEC is currently evaluating this capitalization method but hasn’t made any public comments. Rumors are that the SEC is contemplating whether to consider tokens or coins as securities, which will allow investors to sue issuing companies in case a project doesn’t take off and issued tokens become worthless.

Law firms familiar with securities and online token markets, however, believe that as long as token issuers follow a few simple rules, coins are unlikely to be categorized as securities:

- tokens should be able to live independently of the emitting company

- tokens shouldn’t represent any interest in any cash flow from the emitter

- the emitter should pay income tax on the emitted tokens as they are the proceeds of a revenue event for the emitter

Having said that, lack of regulations gives companies a chance to go to market and innovate at a rapid speed. It gives elbow room to ecosystem participants like startups, investors, and markets-in-general to come up with their own solutions to combat unexpected roadblocks.

Not For the Faint-Hearted

The onus is on the investor to dig deep in getting familiar with a project, its future scope, founding team, etc., and the risks range from fraud management to cyber attacks. But ICOs and new cryptocurrencies have had massive successes, as well. There is no doubt that there are lots of pitfalls on the ICO road, but only an investor can decide if the rewards are worth the pain of extensive due diligence.

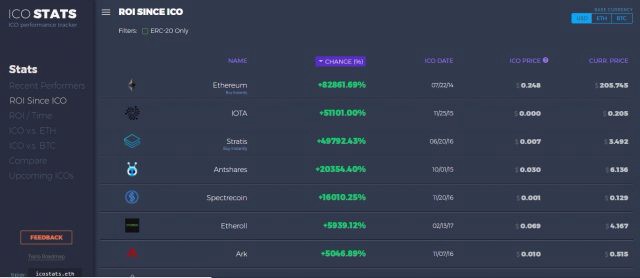

The below graph indicates that ICOs have had some major hits with investors making 50x to 800x returns in months. It makes you consider that maybe the risk-reward ratio is currently skewed towards the risk-taker.

Recent Successes

EOS, which “enables parallel processing of smart contracts and horizontal scalability allowing an estimated 100K transactions per second,” raised almost $190 million in its recent ICO, and Tezos ICO (“which tackles the question of governance and development in the context of a decentralized network”) has raised a record-breaking $232 million. These record-smashing fundraisings showcase that there is massive investor interest, and with hundreds of ICOs scheduled for the coming months, it is going to be a very interesting time for ICOs and larger cryptocurrency ecosystem participants.

The Key Takeaway

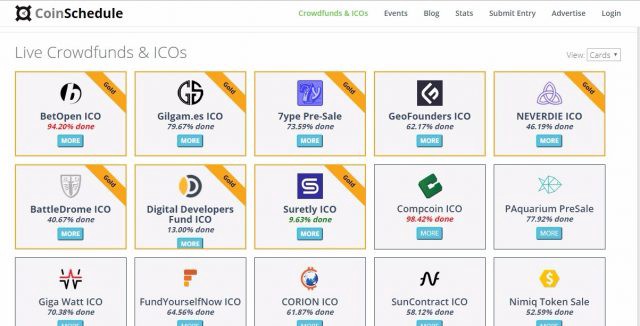

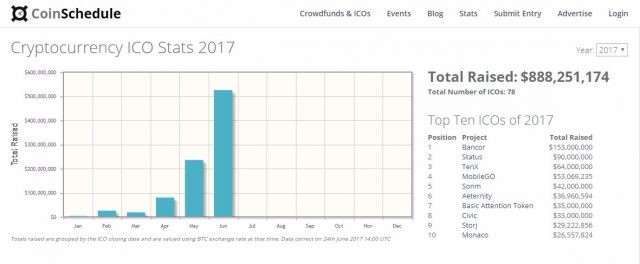

To say that ICO has redefined fundraising is an understatement. Emerging companies are all queuing up to raise funding and planning to develop a cryptocurrency ecosystem. More than 78 companies have raised almost $900 million as of June 2017. July 2017 has been a blockbuster, and the $1 billion mark has been broken for 2017.

The future seems to be extremely speculative for this young fundraising mechanism. Underlying all the hype, sophisticated investors and founders understand that raising capital has been changed forever in this new world order.

Full disclosure: Lending-Times’ Editor-in-Chief George Popescu is also founder and CEO of Lampix, which is doing an initial token launch at the beginning of August 2017

Author:

Written by Heena Dhir.