I recently sat down with Jessica Koehler—Mrs. Minnesota America, Harvard Executive Leadership alum, and advocate for entrepreneurship and personal growth—for an in-depth interview. We talked about my background, the lessons that shaped me, and why I believe the next big wave of opportunity lies in robotics, fintech, and creative reinvention.

George Popescu’s Early Life in Romania

I was born in Romania. Back then it was communist—like North Korea today. You couldn’t leave. They would shoot behind you at the border.

Growing up in that environment, I turned to books—Jules Verne, Magellan, Columbus. Stories of explorers fueled my dreams. When my mother remarried a Frenchman, we moved to France. Later, in 2003, I came to the U.S. to study at MIT, a move that changed everything.

George Popescu at MIT: Research and Discovery

What was meant to be a two-month internship at MIT turned into years of research. I worked on biotech projects using cantilevers—tiny devices designed to measure molecular weight for medical diagnostics. The group went on to publish in Nature and Science.

That period taught me that when you enjoy what you do and deliver results, people want you around. That mindset shaped my entrepreneurial career.

The Core Business Philosophy of George Popescu

When young people ask me for advice, I always share the same mantra:

Say what you’re going to do. Do what you said you’d do. Do it on time and on budget.

Whether in fintech, real estate, or robotics—living by that rule builds trust and long-term success.

Lessons From George Popescu’s Father

My father, a microbiology professor, gave me two timeless lessons:

- Be broadly knowledgeable. Some people know a lot about one thing; others know a little about many things. I’ve followed the second path.

- Never say everything you know. Prepare more than you show, so you’re ready when life shifts.

Entrepreneurship, Integrity, and Resilience

In early 2020, I launched a surf travel business. The first trip sold out. Then COVID hit. I refunded everyone immediately—before they asked. Integrity isn’t proven when things go smoothly; it’s revealed when everything falls apart.

Over the years, I’ve built companies that reached tens of millions in revenue. I’ve also failed. Each venture taught me the same lesson: resilience and integrity define entrepreneurs more than ideas alone.

George Popescu on Creativity: Photography and Painting

After selling a company, I threw myself into creative outlets. Photography became a passion, leading to 40 magazine covers, including Harper’s Bazaar.

Today, I balance business with painting. Oil painting, like entrepreneurship, is messy at first—like baking croissants. But with practice, it becomes deeply rewarding.

The Future: Public Companies and Robotics

I believe public companies have advantages private ones lack—access to cheaper capital, visibility, and credibility. That’s where I’m focusing my next ventures.

I’m also investing my energy in robotics. Today, for about $5,000, you can buy a humanoid robot with arms and legs capable of using the same tools humans do. Imagine one person supervising 20 robots. This won’t eliminate jobs—it will create new categories of work, just as every major technological revolution has for the past 300 years.

George Popescu on Crypto, Blockchain, and Marketplaces

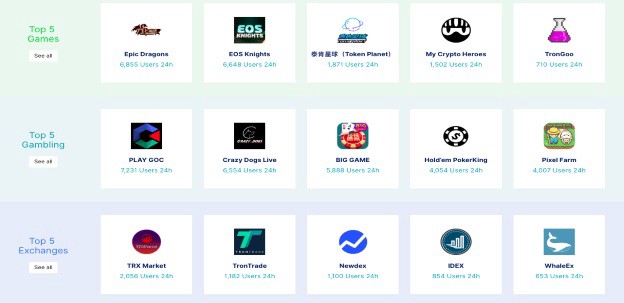

I see blockchain as a legitimate tool in fintech. It will disrupt intermediaries like Amazon and eBay by slashing seller fees from 30% to 5%. Consumers will quickly notice the price difference, and adoption will follow.

On platforms like TikTok, what fascinates me is that human nature never changes. People love stories. A piece of wood means nothing—until you learn it was my father’s last gift before I left Romania. Technology changes, but human nature is constant.

Why America Is the Best Place for Entrepreneurs

I’ve lived in Romania, France, the U.K., and the U.S. Only in America do entrepreneurs truly thrive. In the U.K., if your company fails, you’re banned from directing another for seven years. My first two companies failed; my third succeeded. Imagine if I’d been banned.

In the U.S., failure isn’t fatal. A 23-year-old can walk into a billion-dollar fund and be taken seriously. That freedom to try, fail, and try again is why America produces the world’s biggest success stories.

Closing Thoughts: George Popescu’s Philosophy

From communist Romania to MIT research labs, fintech startups, editorial photography, and now android robotics—my journey has been defined by curiosity, resilience, and relentless drive.

If there’s one lesson I want to leave you with, it’s the one that has carried me through every chapter:

Say what you’re going to do. Do what you said you’d do. Do it on time and on budget.